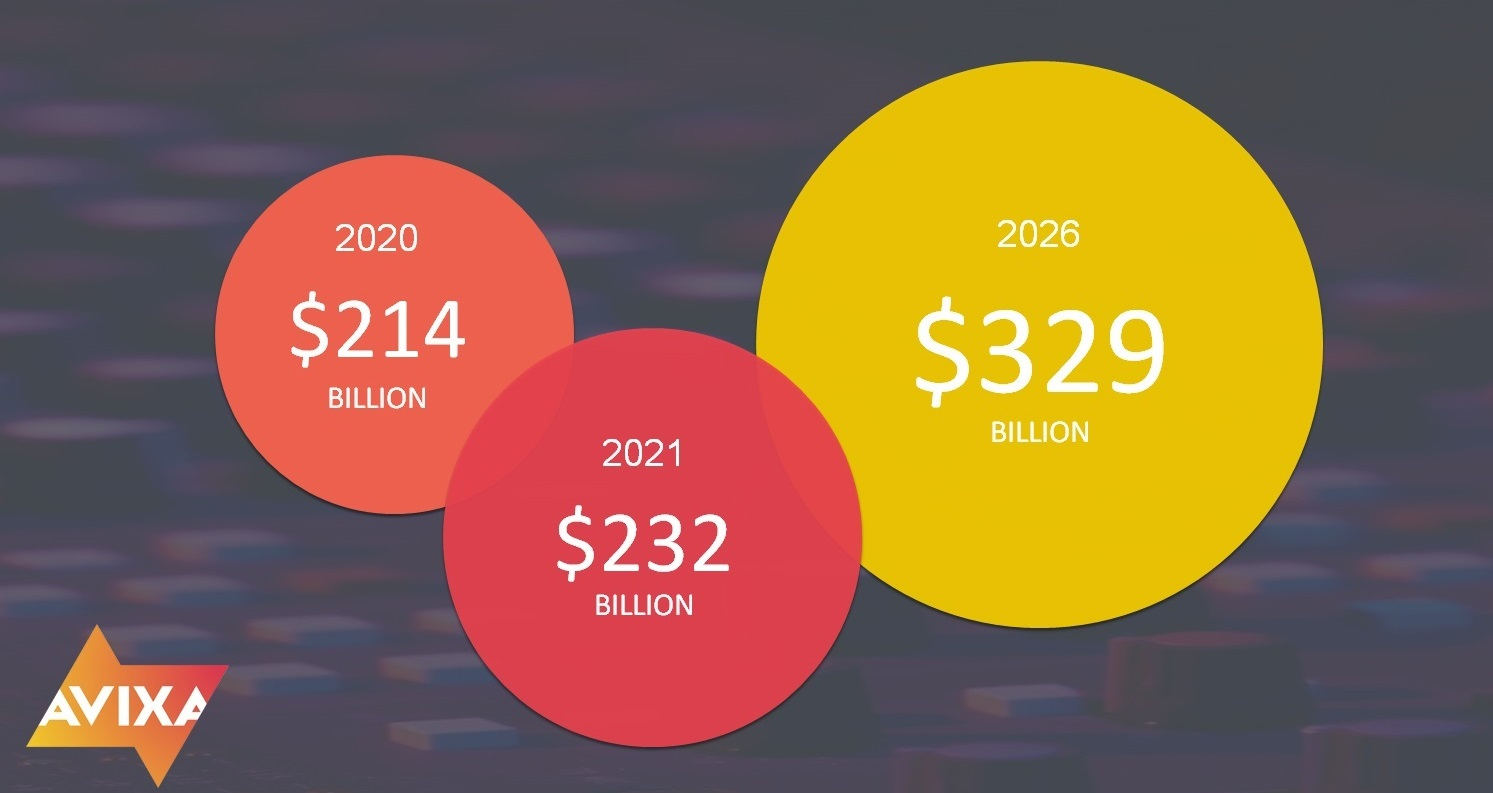

A new 2021 AV Industry Outlook and Trends Analysis (IOTA) produced by AVIXA (the Audiovisual and Integrated Experience Association) reports that after peaking at $259 billion globally in 2019, pro AV industry revenue dropped to $214 billion in 2020 due to the pandemic.

Further, the analysis forecasts revenue will reach $232 billion in 2021 and grow to $329 billion in 2026, representing a 7.2 percent compound annual growth rate (CAGR). The 2021 IOTA explores the global trends within the pro AV industry, providing an overview of AVIXA’s current five-year forecasts of revenues for products and services along with the predominant trends driving these forecasts.

“Back in the early part of 2020, there was a lot of optimism that initial lockdowns and other measures would help get most regions through the worst of the pandemic, thereby allowing economies to rebound and pro AV to benefit,” says Sean Wargo, Senior Director of Market Intelligence, AVIXA. “While true in parts of Asia, this was not the case in much of the world and so pro AV fared even worse than our initial forecasts would indicate. The good news is we are now seeing meaningful recovery, and so strong growth dominates our revised estimates going forward.”

Overall, pro AV revenues were the least impacted in the Asia Pacific (APAC) region. China significantly recovered during the first half of 2020. Overall annual growth for AV spending in the APAC region registered at -16.1 percent, resulting in revenues of $78.8 billion and contributing 37 percent of global spending.

The Americas pro AV market dropped by 16.7 percent to $77.6 billion in 2020, somewhat bolstered by a strong first quarter in 2020. A strong recovery is expected, with 2021 revenues rising to $83.6 billion. The Europe, Middle East, and Africa (EMEA) region was the hardest hit due to more challenged economies going into the pandemic and many factors creating variety in rate of recovery. Spending in 2020 on pro AV in the region declined by 19.7 percent to $57 billion.

Conferencing and collaboration generated the highest revenue as workers went remote, students participated in distance learning, and events went virtual. The market segment is forecast to generate $43.5 billion in 2021 and reach $49.9 billion in 2026.

Digital signage is poised for strong revenue growth, with a forecast of $32 billion in 2021, increasing to $44.7 billion in 2026. The signage market had strength going into the pandemic, as display prices encouraged proliferation. This remained as pent-up demand, which will propel the market. Media servers are the leading product category for digital signage with $6.9 billion in revenue in 2021.

Overall, content management hardware, previously termed by AVIXA as streaming media, storage, and distribution (SMSD), generates significant revenue and growth over the next five years – $62.3 billion in 2021 with a CAGR of 10.4 percent.

Live events and performance/entertainment were the most impacted in 2020, with a combined annual revenue decline of 49.7 percent. These segments are forecasted the slowest recovery to pre-pandemic levels due to continuing restrictions and individual reluctance to join larger events and crowds. However, both areas will bounce back substantially, setting new records over the next couple of years. By 2026, live events will generate $33.9 billion in revenue and performance/entertainment $30.6 billion.

The IOTA report is produced by AVIXA in conjunction with Omdia (formerly IHS Markit), a global research firm with specialty across a number of underlying supply chain markets, many of which overlap with the principal components of the pro AV industry. This specialization provides connections with manufacturers, distributors, integrators, and larger end user firms that provide and consume pro AV products and solutions. This translates into sources of data that are modeled in conjunction with key macroeconomic data to generate the forecasts shown herein.

Go here to learn more about the 2021 AV Industry Outlook and Trends Analysis (IOTA).